As the landscape of research and development (R&D) relief claims in the UK continues to evolve, businesses and accountants must stay updated with the latest changes. Recently, HMRC (His Majesty’s Revenue and Customs) introduced new rules and requirements to ensure that R&D claims are processed smoothly. However, HMRC is rejecting around 50% of applicants due to the absence of an ‘additional information form’ (AIF) that they must submit before the tax return. To help businesses and accountants avoid this issue, HMRC is taking proactive measures by notifying customers and their agents about the invalidity of their R&D claims and providing clear instructions on rectifying the situation. By staying informed and following the guidelines carefully, businesses can ensure successful R&D claims and reap the benefits of the relief.

New Requirements for R&D Claims

As of August 8th, 2023, HMRC requires companies to submit an ‘additional information form’ before filing their tax returns to support their R&D claim. This new step ensures businesses provide additional details and evidence to strengthen and validate their claims.

In some cases, it may be possible to file an amended CT600 Corporation Tax Return along with the ‘additional information form.’ However, it is essential to ensure that the information provided in the form matches the data in the tax return. For comprehensive guidance on this process, please refer to ‘The Company Tax Return Guide.’

The Essential Components of Your Corporation Tax Return

When claiming R&D relief on your Corporation Tax Return, it’s essential to include the following components:

- If you have sent an additional information form, mark an ‘X’ in box 657.

- If you have sent a claim notification for accounting periods starting from April 1st 2023, draw an ‘X’ in box 656.

- If your company claims payable or expenditure credit, complete the CT600L 2022 version 3 form.

- Provide the computations for the relevant accounting period.

- Provide the accounts for the applicable accounting period.

- Make sure to include the bank account details for your business.

Consequences of Non-Compliance

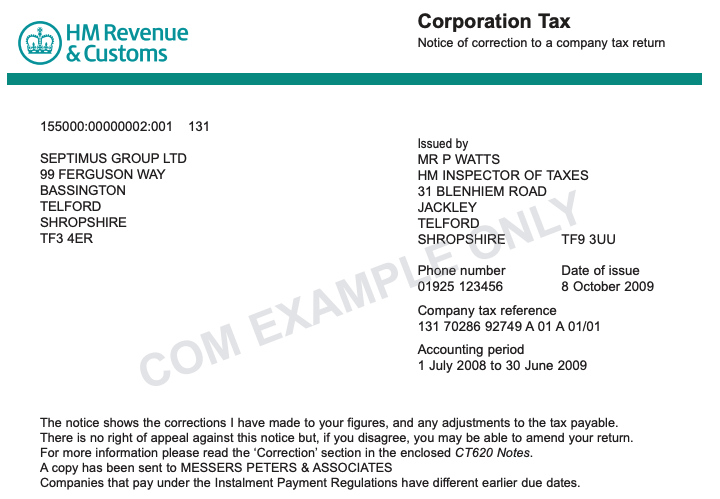

It is essential to note that if your R&D claim fails to meet the new criteria, HMRC will remove it from your Company Tax Return. You will receive a CT620-COR notice confirming this change and outlining any revised tax calculations. We recommend that you take the necessary steps to ensure your claim meets the required criteria to avoid unnecessary delays. This proactive approach will help to safeguard your financials and facilitate a smooth and hassle-free process.If any of this is unclear, we always advise seeking the advice of a specialist tax advisory firm (such as Counting King) who will ensure this is completed accurately and compliantly every time.

What to Do if You Disagree with a CT620-COR Notice

If you disagree with its contents, you cannot appeal directly against a CT620-COR notice, but you can still make amendments. To do so, you must communicate with HMRC within 90 days of the notice date, explaining why you think the notice is incorrect. HMRC will review your amendments and decide whether to confirm or withdraw the notice based on your argument’s merit.

Further Information and Resources

For more information on R&D tax relief and claiming R&D tax reliefs, you can visit www.gov.uk and search for ‘Research and Development tax relief’ and ‘Claiming R&D tax reliefs.’ Additionally, ‘Agent Update issue 107‘ contains valuable information regarding R&D changes and other general updates, which you can find on the government website.

For information on claiming R&D tax credits click here to start the process today!

Both businesses and accountants must stay updated with the latest changes in R&D support claims. By ensuring that your submissions are accurate and comply with the new requirements, you can avoid unnecessary rejections and enjoy the benefits of R&D tax relief. Counting King offers comprehensive training to accountants and guides clients through the process in an easy and compliant manner.

Counting King can help you

Counting King are experts at submitting R&D tax claims for their clients – contact us today to see how we can help you.

About Counting King:

Counting King is a leading financial advisory firm specialising in tax, accounting, and financial consulting services. The dedicated team empowers businesses of all sizes to navigate complex economic landscapes, optimise tax strategies, and achieve sustainable growth. For more information, visit https://countingking.co.uk.